“The last hike they made potentially could be the last for the year,” said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. The Fed has maintained that it is ready to keep raising interest rates if it has to, but will base its next moves on the latest economic data. The central bank held rates steady at its last meeting and investors are expecting rates to hold steady for the remainder of 2023, according to CME’s FedWatch tool. The latest inflation data follows updates on jobs and consumer confidence this week that also support hopes for the Fed to pause interest rate hikes. PCE measured 3.3% in July, matching economists expectations. The goal has been to rein inflation back to the Fed’s target of 2%. The central bank has raised its main interest rate aggressively since 2022 to the highest level since 2001.

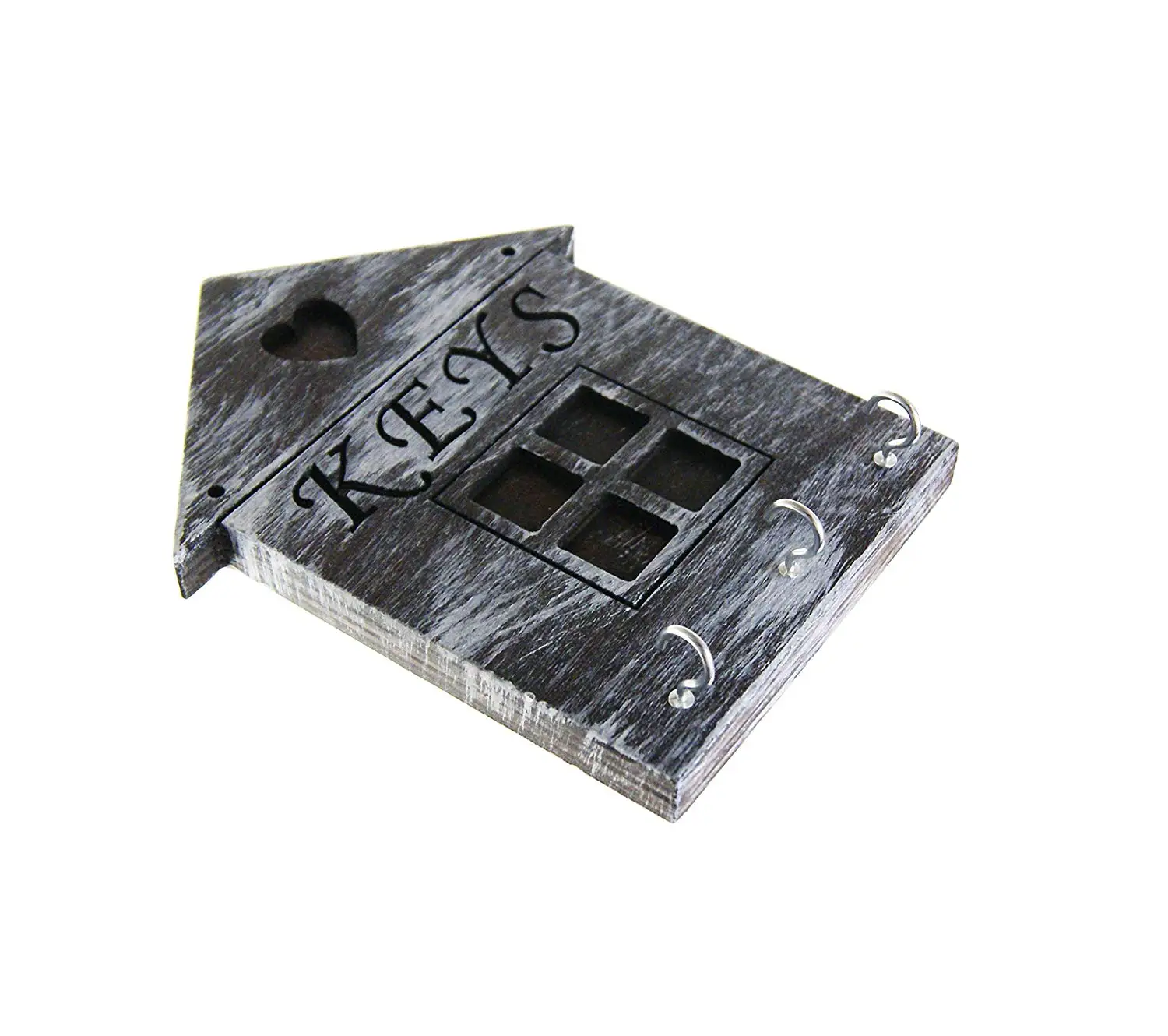

#Asian wall mount key holder update

The latest update for personal consumption and expenditures, or the PCE report, is the latest sign that price increases are cooling. On Thursday, the government reported that a measure of inflation closely tracked by the Federal Reserve remained low in July. “But if we get cooler jobs data, cooler inflation data, if we get cooler spending data, that’s what brings rates down dramatically and that gooses stocks higher.

“We’ve kind of entered this point of the year where economic data and earnings are mostly set, in terms of the market’s expectations,” said Michael Antonelli, market strategist at Baird. The S&P 500, which soared 19.5% through July, remains 17.4% higher for the year, while the tech-heavy Nasdaq is up 34.1%. That helped limit the market’s losses for August.

0 kommentar(er)

0 kommentar(er)